Charitable Planning

Remember the adage "It's better to give than to receive"? With proper planning, it's possible to do both at the same time. Your financial goals may include giving to the causes that are most important to you. As you plan, these strategies can help you make the greatest impact while potentially receiving tax savings too.

The tax aspects of charitable giving can be complex. It's always a good idea to consult a tax professional about your giving strategy. That said, here are a few ground rules for charitable giving:

There are annual limits on a deductible donation. In general, your donation deduction will be limited to 50% of your adjusted gross income (AGI) — unless you only give cash, in which case the limit increases to 60% of AGI. In contrast, the limit on donating appreciated assets to qualified charities is 30% of your AGI. These limits are reduced for donations to certain organizations, such as private foundations.

The tax advantages of a charitable contribution generally depend on three factors: the recipient (only donations to qualified charities are deductible), how you structure the gift, and the type of property you choose to give. Different types of property donations—whether it's cash, business assets, or investments—offer different tax advantages and drawbacks.

Donating long term assets—especially highly appreciated securities—instead of cash can be a very effective and tax-efficient way to support a charity. Generally, if your assets have appreciated in value, it's best not to sell securities to generate the cash you need for a donation. Contributing the securities directly to the charity increases the amount of your gift as well as your potential deduction.

One rule to remember here is that the deduction is limited to 30% of your adjusted gross income (AGI). If you're not able to use the entire donation deduction this year, you can still carry forward unused deductions for five years. However, if you're planning a large donation that's close to or exceeds your AGI limit, consider talking to a tax professional before making your donation.

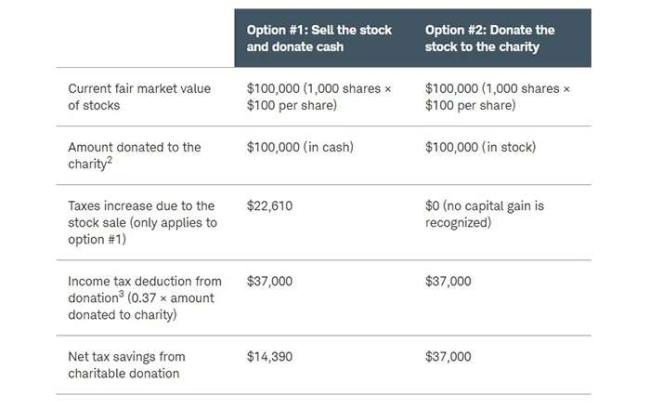

Here's an example of how donating appreciated investments can increase the amount of a donation. Let's say Evan and Katy are married, file a joint tax return, and want to donate $100,000 worth of stock to their local animal shelter. They are in the 35% federal ordinary income tax bracket and are subject to the 20% long term capital gains tax rate, plus the 3.8% net investment income tax. They have two options: they could sell the stock and donate the cash, or they could just donate the stock directly to the charity. The chart below shows that donating the stock would result in a much larger tax savings in this situation.

The example is hypothetical and provided for illustrative purposes only.

Assumes a cost basis of $5,000, that the investment has been held for more than a year, and that all realized gains are subject to a 20% long-term capital gains tax rate and the 3.8% net investment income tax. Assumes donor is in the 37% federal income tax bracket and does not take into account any state or local taxes. Certain federal income tax deductions, including the charitable contribution, are available only to taxpayers who itemize deductions, and may be subject to reduction for taxpayers with AGI above certain levels. In addition, deductions for charitable contributions may be limited based on the type of property donated, the type of charity and the donor's AGI. For example, deductions for contributions of appreciated property to public charities generally are limited to 30% of the donor's AGI. Excess contributions may be carried forward for up to five years.

Donor-advised funds, for example, allow you to make a donation of appreciated stock held long-term and receive a current-year tax deduction. You can then grant those assets out over time and have the remaining assets invested so they can grow for future grants to worthwhile charities.

If you prefer to leave assets to charity but also earn income for a period of time, a charitable remainder trust (CRT) or pooled income fund is worth exploring. We often refer to this type of trust as a Charitable Retirement Income Plan. For someone charitable, a CRT can be a useful tax strategy to turn a highly appreciated asset into retirement income.

Another donation option to consider if you're over age 70 1/2 years is a qualified charitable distribution (QCD) from your tax-deferred retirement account, such as a traditional IRA. A QCD is a tax-free distribution from a retirement account that can be donated directly to a qualified charity and does not have to be taken into your income for tax purposes. In addition, a QCD can also be used to meet up to $100,000 of the required minimum distribution for your IRA. It should be noted that there is no tax deduction for a QCD; however, you don't have to include that distribution into your taxable income.

The bottom line

Each of these donation strategies and vehicles offers different benefits, but in the end, what really matters is helping an organization that matters to you. The tax benefits from a donation are just icing on the cake. Our team can help you determine the best way to give for your particular situation.